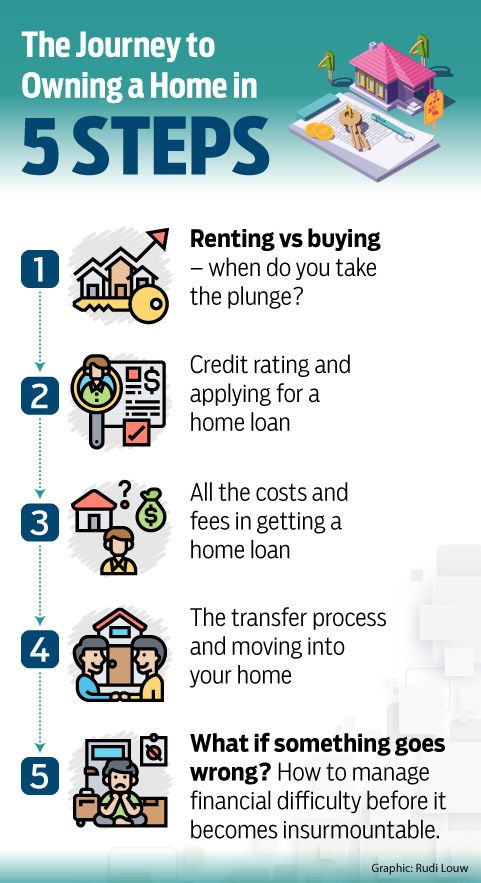

Meet Bontle – our first-time home buyer

Meet Bontle, over the next six weeks Maya Fisher-French will be following her journey to owning her first home – the highs, the surprises, as well as the cautionary tales. Join us as we follow the steps to home ownership, whether you are a first-time buyer, downscaling, or trading up - getting the right information and knowing what to ask can save you money, time and bad experiences.

Part 1: Meet Bontle: Guiding a first-time buyer

Maya Fisher-French

Buying a home is something many South Africans aspire to. It is the biggest single transaction most of us will make in our lifetime, yet how much do we really understand about the process?

Over the next six weeks, City Press in partnership with Capitec, will take you through the journey of buying a home by following the story of first-time homeowner Bontle.

Bontle has been desperate to purchase her own house for the last two years. She wanted a home for her four-year-old daughter, a place with space to play and ideally a swimming pool. The problem was that Bontle found most properties out of her price range. “All I could afford was a tiny flat. I didn’t want to pay that amount of money and live on top of someone else, but even new developments were above my budget,” says Bontle.

But then Covid-19 hit. while the pandemic had a devastating impact on many people’s income, it also saw a dramatic fall in interest rates. The prime lending rate fell by nearly a third, from 10% to 7%. Suddenly Bontle’s affordability improved, and she was able to afford a higher mortgage. At the same time there was an increase in sellers and many people looked to downsize to cut costs.

"Suddenly Bontle’s affordability improved, and she was able to afford a higher mortgage. At the same time there was an increase in sellers and many people looked to downsize to cut costs."

“People recommended that I look at Kempton Park for a freestanding house. Mostly the properties were in gated communities, but these were out of my budget. But then one day I got a call from my estate agent,” explains Bontle. A stroke of luck, her estate agent’s neighbour was looking to sell. They had retired and needed to move into a smaller place as the running costs were hurting them. Their daughter had found a place for them in a retirement village, and they needed to sell urgently.

Bontle had found her dream home, a four bedroom, two bathroom freestanding house with a pool – and it was within her price range.

Bontle had already applied for a pre-approved mortgage and the bank had approved a mortgage of R1.6 million. “While I had qualified for that amount, I knew I could not manage the repayments and still spend money on fixing the home, so I made an offer of R1.45 million”. After paying a deposit of R72 500, Bontle’s total mortgage commitment was R1.377 million.

As the seller had been struggling financially, the property needed some attention – the pool was green and in need of repair. “I insisted on the pool being repaired as part of the offer to purchase,” says Bontle, who also requested a statement to fully understand the monthly rates, water and electricity costs.

Her bank approved the mortgage at an interest rate of 8.2%, but then Bontle heard that Capitec had recently launched a home loan offering. “I thought it would be worth finding out if they could better the offer, which they did at 7.7%.” To afford the monthly repayments Bontle has taken out a 30-year mortgage, however, once she has stabilised her finances after the costs of buying the property, she aims to pay in extra each month. Currently Bontle’s repayments are R10 337 a month. To settle the mortgage over 20 years, Bontle would need to increase her repayments by R1522 a month to R11 859.

"I thought it would be worth finding out if they could better the offer, which they did at 7.7%"

While Bontle thought she had done all her homework, having saved for a deposit and bond registration, she was surprised to discover that there are more fees when it comes to buying a property – transfer costs paid to the conveyancing attorney to lodge the title deed, transfer duty on a property value above R1 million, as well bond registration costs.

“I knew about the bond registration costs from the mortgage quote, but I thought it covered all those fees. I wish the estate agent had told me about the real costs,” says Bontle, who had to put the unexpected fees onto her credit card. This will be paid off by any additional commission that she earns through her sales job.

As Bontle and her daughter move into their new home, she will also start to absorb the real costs of homeownership. It will take some sacrifice and commitment, but over time her finances will adjust, the financial stress will ease and wonderful memories will be created.

Next week we will take a closer look at the buying decision.

When do you rent?

When do you buy?

What costs do you need to consider as a homeowner?

Part 2: Renting vs buying – when do you take the plunge?

Maya Fisher-French

While most of us dream of owning our own home and no longer paying a landlord’s mortgage, jumping into home ownership should not be a step taken lightly. You need to first do your homework, test your financial robustness, and fully understand the cost implications of home ownership. If you run into financially difficulty it is not as simple as giving notice to your landlord – if you default on your mortgage repayments, you stand to lose your home.

To help save the deposit for her new home, Bontle moved back in with her parents.

To help save the deposit for her new home, Bontle moved back in with her parents.

The decision to switch from renting to buying has been made more attractive by the current low interest rates. For many, a mortgage repayment may now be in line with what they are paying in rent. This creates the opportunity to move into the property market. For example, on a mortgage rate of 8% (one above prime) your repayment for a 20-year mortgage would be around R8400. The mistake one could make is thinking that if you are able to afford rental of R8400, then you can afford to buy a home.

Home ownership has many other costs, and you need to consider these first:

What will it cost to run the home?

There are more costs to home ownership than there are for someone renting. You will have to pay rates and taxes, utility connection fees, levies and maintenance. These could add up to 30% of your mortgage costs. If your mortgage is R8400 a month, you will need to budget for at least an additional R2500 extra for running costs.

If you are looking at properties, make sure the estate agent provides you a statement to show you all the monthly costs. Ask for the rates, utility and levies bills. If the property is on a pre-paid meter, ask to see the amount the current homeowner is paying each month. It may be worth spending the money on a home inspection before you buy so you know if there are any defects that either the homeowner needs to rectify or that you need to budget for in terms of maintenance. A home inspection costs around R4500.

In Bontle’s case, she could see that the pool was not in working order and requested that this be rectified as part of the offer to purchase. She also asked for the rates bills and the estimated amount the sellers spent on electricity. While the electricity bill for the retired couple was only R1000 a month, she was warned that once the pool pump was operational, it could add a few hundred rand to the electricity bill. With just the rates, water and electricity bills Bontle needed to add R2400 to her homeowner budget.

What will it cost to buy?

When you come to buy a property there are many upfront costs you need to consider. Most banks will require a deposit of up to 10% of the purchase price. Then there are transfer costs paid to the conveyancing attorney, transfer duty (tax) on a property valued more than R1 million as well as bond registration costs.

Though the pool was a one of the most attractive features of the home, Bontle had to allow extra money in her budget to keep the pool pump going.

Though the pool was a one of the most attractive features of the home, Bontle had to allow extra money in her budget to keep the pool pump going.

As our first-time homeowner Bontle had the goal of finding a home for her and her daughter, she made the decision to move in with her parents. While helping them with the day-to-day expenses, she was still saving a lot of money by not having to pay rent. This gave her the opportunity to save up for the deposit and bond registration costs. However, she was still surprised to discover that there is another set of attorney fees to cover the cost of transfer. As she had not prepared for these, she had to put these on her credit card. This added a financial cost she had not prepared for.

Ideally you want to save up enough money to cover all these expenses upfront and not have to take on more debt. While Bontle was able to save on her rent, not everyone is in the same position. If you are currently renting, calculate how much more it would cost you to be a homeowner – the difference between your current rental and potential mortgage as well as running costs.

The best way to understand your mortgage costs is to apply for a pre-approved mortgage. Ask your bank what mortgage they would approve, at what rate and the monthly repayment. Bontle had a pre-approved mortgage which made her offer more enticing. A seller is more likely to agree to an offer if they know the bond is likely to be approved.

Once you understand how much more homeownership will cost, put this money away each month towards your home ownership ‘war chest’. This is not only to provide you with the money to pay the fees, but you will also have a better understanding of whether or not you can afford to be a homeowner. If you are struggling to put those extra funds away, then you may need to revise your affordability.

Next week we look at the process of applying for a home loan and how your credit rating could affect your application.

Part 3: What to know when applying for a home loan

Before you even start on the hunt to buy a home, find out first what you qualify for, writes Maya Fisher-French

Before our first-time buyer Bontle made the offer to purchase she had built up a deposit of R72 000 and obtained a pre-approved home loan from her bank at an interest rate of 8.2%. However, after signing the offer to purchase she decided to shop around to see if she could get a better mortgage offer. Capitec was able to offer her a rate of 7.7%.

According to Wiehahn Kock, head of Business Solutions at Capitec, there are several factors that affect the interest rate when approving a home loan application as interest rates reflect the risk premium the banks place on the mortgage.

- Home or investment property? A primary property – in other words your home – will usually have a lower interest rate than an investment property. Banks know that people are most likely to prioritise their home repayments and therefore it carries a lower risk.

- How big is the deposit? The size of your deposit will determine the loan versus the value of the property. The lower the mortgage relative to the value of the property, the lower the risk to the bank. Kock says a deposit of 20% or more would be considered as a low loan-to-value home loan. This will have a very positive impact on the interest rate charged to the client. If the deposit is less than 20% this would be classified as a high loan-to-value mortgage, however, the fact that there is a deposit would still have a positive impact, which is why Bontle qualified for a lower rate. Kock says a deposit also improves your affordability as your repayments will be lower.

- What is the credit score and employment status? The next step is to look at the individual. A client with a higher score is considered a better credit risk and a lower interest rate would apply. Having a history of a stable employment would also improve your risk profile and therefore your interest rate. Self-employed people may be considered a higher risk, however, Kock says if one can prove consistency in earnings then this could lower the interest rate charged.

Once the interest rate and therefore monthly repayment has been determined, the bank then assesses the affordability of the customer to meet those repayments.

By asking for a pre-approval you will have a sense of whether your current finances are sufficient to qualify. If you are turned down, or the interest rate charged is well above prime, it could make sense to delay buying a home and focusing on improving your credit score and affordability.

Credit score – and how to improve it

If you have legal action against you or a poor credit score due to non-payment of loans, the bank may decline your application. However, in most cases where an application is approved, your credit score still matters as it impacts the interest rate that you would be charged.

It usually takes around six months for your credit score to reflect an improvement if you take these steps:

- You can improve your credit score by ensuring the payments on all your loans are up to date.

- If you have multiple unsecured loans such as store cards, making these paid up and closing them could also have a positive impact on your credit score.

- If you are looking to create a credit history, you can take out a credit card but set the limit really low like R2 000 a month and make sure you pay in full at the end of the month.

- Financial commitments like payments to policies and insurance premiums all count towards your credit score.

Affordability – and how to improve it

Kock says that one of the main reasons for turning down home loan applications is due affordability – even if the customer’s credit score was acceptable. You must be able to afford the repayments for the mortgage to be issued.

There are several ways to improve your affordability:

- Pay off short-term debt. This will free up cashflow to put towards your mortgage repayments. If you are over-committed on car finance, it may make sense to focus on paying off the car as quickly as possible and then applying for home finance.

- Build up a deposit. While banks do offer 100% mortgages, in some cases a bank may require a deposit. Even if you qualified for 100% mortgage, if you can put down a deposit, the amount you need to borrow, and therefore repay is reduced. It also shows the bank that you have the ability and discipline to save.

- Include additional income. Kock says the bank will consider additional streams of income such as a side business in terms of affordability. So even if you are earning a few thousand rand from some after-hours work, make sure you include it in your application.

- Your rent counts. Most applicants are currently paying rent. Koch says the bank will take into account that the rent would be freed up to pay towards the mortgage. Having paid rent timeously each month will also reflect on your bank statement and improve your credit risk.

Keep in mind that even if a bank approves a mortgage, you need to check that you can really afford it. There are many additional costs to being a homeowner that you will incur once you move in. Although Bontle qualified for a mortgage of R1.6m million, she chose to purchase a property at a lower cost and only committed to a mortgage of R1.3 million.

FREQUENTLY ASKED QUESTIONS

Should I fix my interest rate?

With interest rates currently so low, is now the time to fix your home loan rate? While Capitec only offers variable bonds that are linked to the prime interest rate, some banks offer a fixed interest rate. The problem is that fixed rates are always higher than the current rate, in the same way that a bank offers a higher interest on longer-term fixed deposits. Banks will also only offer fixed rates over one to three years. If you selected a fixed rate for three years you could pay up to 2% points higher than your current rate. Rather than fixing at a higher rate, increase your repayments. You know you will be able to absorb any future rate hikes and that extra payment goes straight to paying off your capital rather than servicing a higher interest rate.

Is now a good time to buy with rates so low?

The lower interest rates have made buying a home more affordable. However, you do need to keep in mind that we are at the bottom of the interest rate cycle. Once the economy starts to recover and inflation creeps up, we can expect to see rate increases in the future. No-one is certain when this will happen, but it will most likely happen in the next two years. Keep this in mind when assessing your affordability. How much would future rates need to increase to affect your ability to repay the mortgage? The upside is that hopefully in two years’ time you would have had a salary increase and be better able to afford any increases.

What is the difference between a home loan and a mortgage?

The terms are used interchangeably, but there is a technical difference. The home loan is the credit facility that the bank grants, while the mortgage bond refers to the legal agreement that is in place – but for practical purposes it is the same thing.

Part 4: Transferring the house into your name

Maya Fisher-French

Once your bond is approved, the paperwork starts, and legal fees need to be paid. Make sure you understand not just the cost, but also the process writes Maya Fisher-French

While Bontle thought she had done all her homework, having saved for a deposit and bond registration costs, she was surprised to discover that there are even more fees when it comes to buying a property.

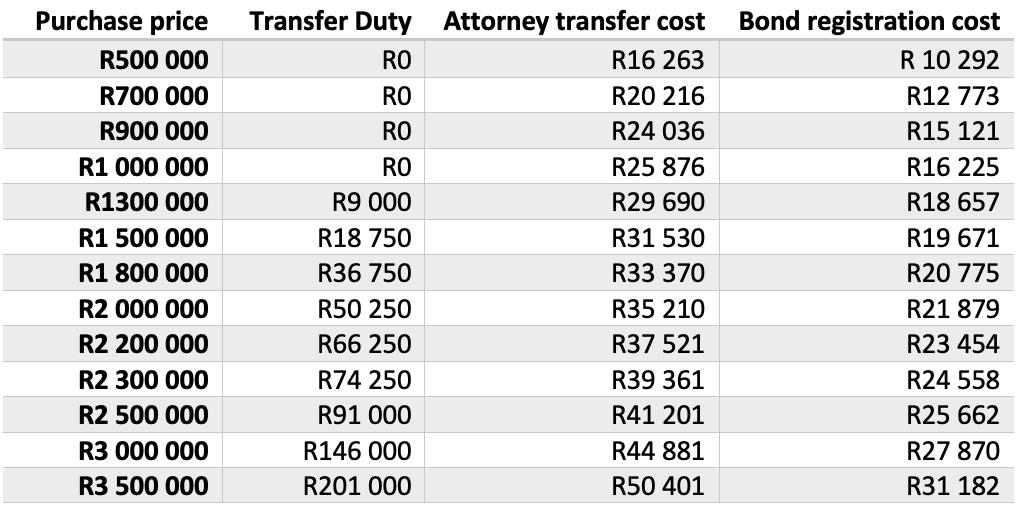

Apart from bond registration costs there are also transfer costs which need to be paid to the conveyancing attorney to lodge the title deed and transfer duty if the property price is above R1 million. In Bontle’s case, the total bill for all these fees was R73 476.

“I knew about the bond registration costs from the mortgage quote, but I thought it covered all the fees. I wish the estate agent had told me about the real costs,” says Bontle whose unexpected transfer costs, including the attorney fees and transfer duty, came to R 47 985.50 which she had to put onto her credit card.

Attorney transfer costs: This is payable to the attorney for transferring ownership into your name, and is calculated according to the purchase price. The attorneys will also charge you for smaller, variable costs such as FICA fees, instruction fees and postage. These fees follow published guidelines, and the seller appoints the transferring attorney, even though the buyer pays the attorney.

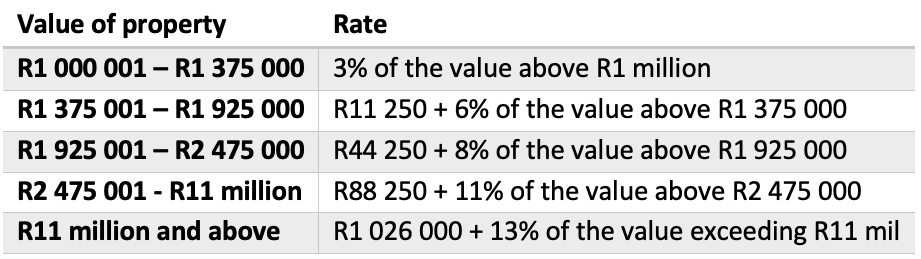

Transfer duty: This is a tax paid to SARS on properties exceeding R1 million and is based on a sliding scale:

Bond Registration: You pay another set of attorneys to issue the mortgage over the property and register the bond with the Deeds Office. These attorneys are usually appointed by the bank. There is also a bank initiation fee on the issuing of a new home loan. You can negotiate the legal fees with the bank and Capitec offers a 40% discount on bond registration fees. Bontle paid a total of R 25 491.20 which included the R6037.50 initiation fee charged by Capitec Home Loans and is applicable to all property values. Capitec offers a 50% discount on bond registration fees for Switches and Refinances.

The table below provides approximate costs to give you an idea of what to expect. These amounts include VAT but may vary from attorney to attorney.

*as at 1 July 2020. Excludes any costs associated with clearance certificates for sectional title properties.

*as at 1 July 2020. Excludes any costs associated with clearance certificates for sectional title properties.

Waiting for transfer

From the time the application is approved it takes around three months for a property to be transferred into your name. Despite purchasing the property in November while under lockdown, Bontle’s transfer took place in just over three months. However, delays could happen such as:

- Delays from Municipalities in providing rates clearance certificates

- Deeds office delays due to closure over the festive season or short staff issues due to lockdown

- Delays in linked transactions where the transfer is linked to another property transaction (eg buyer’s sale falls through or seller’s new home transfer is delayed)

- Conditions in granting of loan (eg engineer’s certificate required due to structural concern)

- Divorce or estate late matters often delay transfer

In some cases, the buyer may want to move into the property before transfer and pay occupational rent. This would have to be agreed and form part of the offer to purchase agreement. Wiehahn Koch, head of business solutions at Capitec explains that if the buyer wishes to take occupation prior to transfer they would need to pay the agreed occupational rent to the seller for the period they occupy the property prior to transfer. It is important that the buyer does not make any capital expenditure/improvements to the property prior to transfer as they are not yet the registered owner.

If something should happen to prevent transfer, this could mean they could lose whatever they spent on the property. Should the buyer take early occupation they must ensure that the household content insurance of the seller is still in place as the risk only passes to the buyer on transfer.

Frequently Asked Questions:

What are the pros and cons of taking out a joint mortgage?

A joint application can help increase your chances of qualifying as both parties’ incomes and expenses are taken into account to assess the affordability based on their disposable income. However, you need to understand the legal ramifications including the fact that you are liable for the full home loan repayments should your partner default.

Pros:

- There is a high likelihood that the housing loan application will be approved if both individuals have a good credit record.

- You can afford to buy property that one partner wouldn’t necessarily afford with their salary alone.

- You could benefit from a good interest rate as affordability assessment is done on both parties.

Cons:

- If you are not married, you will share ownership of the property with another individual once paid off.

- If there is a default, both partners’ credit records are affected. That means if your partner stops paying their portion, your credit record is affected.

- Should one partner want to pull out of the bond agreement, a new bond application will have to be processed and a full credit assessment conducted on the application to verify affordability.

- In addition, the home loan facility will be closed, which means you will have to pay bond registration fees for the new home loan facility.

- Upon the approval of the home loan, the bank may require both applicants to have adequate life cover that will be ceded onto the bond.

During the application process, both parties need to sign all the necessary documents such as the offer to purchase, home loan quote and legal documents, etc. Most importantly, the monthly debit order has to come from one account. As a result, this will have to be agreed beforehand to ensure that there are always funds available to avoid defaulting on the monthly bond repayments.

What are the pros and cons of buying a property with cash?

Buying with cash saves you money not only on the interest you would pay on the home loan but also the legal and banking fees associated with taking out a mortgage. However, if you are using up all your emergency funds and leaving yourself with no liquidity, then there could be an advantage to taking a small value home loan, especially if you are considering future home renovations. Home loans tend to have lower interest rates than personal loans, however, you need to balance this against the costs of registering a home loan.

If you are buying with cash, make sure you still use a reputable attorney to conduct the transfer. There have been horror stories of people buying houses from sellers who do not own the title deed. No monies should ever be paid directly to the seller, rather the funds need to be held by the attorneys in a trust account until transfer has taken place. This principle applies to deposits as well, they should never be paid to the seller or estate agent, only to the attorney handling the conveyancing.

Part 5: Moving in – the big day arrives

When buying your home, make sure you have included the running costs in your budget, writes Maya Fisher-French

There is nothing more exciting, or nerve-wracking, than moving into your new home. You will remember the moment forever, as you sit on the floor unpacking boxes, sipping a glass of wine you realise that this is yours! This is the place where you will build memories and possibly raise your children. You have so many ideas and images about what this life will look like.

But then you realise you need to buy curtains, possibly some furniture (either because you have none or that couch/fridge doesn’t fit) and those ugly carpets really have to go at some stage. Moreover, you are still waiting for the shock of the first mortgage payment.

“I was hoping for an email saying, ‘there will be a delay in the first installment date’,” laughs Bontle. “While I was prepared for my first installment, honestly when it went off, I did have an ‘oh goodness it is actually happening’ moment”.

Apart from the mortgage payment, moving into your new home has additional costs you need to consider:

Utility connection

Before she moved in, Bontle had to pay for municipal connection fees. These came in at R1 459, but could have been higher if she was not on a pre-paid electricity meter. Some municipalities ask for a deposit to cover your first few months of utility bills.

Household contents/ moving

If you already have household contents, you may need to hire a removal company to move them for you. As Bontle was a first-time homeowner she did not have much to move except for clothing and her daughter’s furniture, for which she used the family van and muscle to do the move. However, she needed to furnish her home and all the furniture was brought brand new to make the house livable such as TV, couch, beds, fridge, microwave, kettle, iron and pots. Having a housewarming party is a great way to encourage friends to arrive with gifts like pots and pans – but make sure you don’t end up spending more money on entertaining them!

Insurance:

Most banks require a home loan customer to have life insurance or mortgage insurance to cover the debt should the customer pass away or become unable to work through disability. Bontle pays R493 to insure her mortgage, but the amount depends on the value of the loan and one can cede an existing policy or shop around with other insurers. The bank will also require building insurance in case something happens to the property. This covers common events like burst geysers or pipes, flood or hail damage as well as large events such as a fire. Bontle pays R598 a month for building insurance.

As a homeowner who is now accumulating belongings, Bontle is also preparing to take out insurance for her household contents. For example, she could buy R150 000 of content insurance including R10 000 cover for a cellphone and R10 000 for a laptop for around R220 per month.

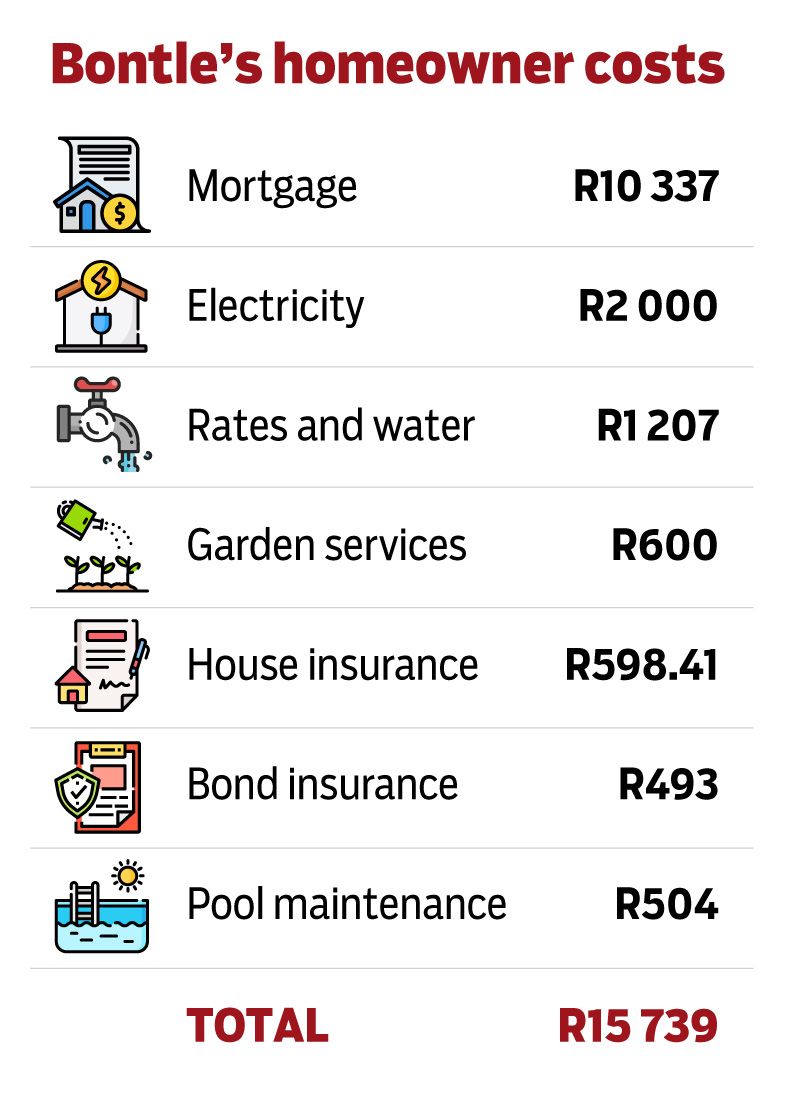

Bontle’s budget

Having now lived for a month in her new home Bontle is adjusting to her homeowner’s budget. Electricity has come in at a much higher rate than she hoped, mostly due to the cost of running the pool pump. The running costs of her home have added R5 402 to her monthly budget, and she is still planning on taking out household insurance. Her running costs are more than 50% of her mortgage repayment which is R10 337.

Part 6: Paying off your home

Once you have stabilised financially from the costs of buying a home, or you get salary increases, consider paying extra to your mortgage to shorten the time you will pay it off and save on interest, writes Maya Fisher-French

One of the most common myths when it comes to taking out a home loan is that you must apply for a 20-year mortgage. While the most common home loan period is 20 years, a bank can offer a mortgage for as short a period as five years all the way up to 30 years.

The period of the mortgage is determined by your affordability. The longer the period, the lower the monthly installments, however, over time you pay more interest. Ideally you want to have as short a period as you can afford.

Bontle opted for a 30-year mortgage, this allowed her some breathing space while she adjusted to her new homeowner budget and increased living expenses. This does not mean, however, that she can only pay the home off over 30 years. Once Bontle is more financially secure, she can increase her monthly payments to pay the property off sooner. For example, to settle the mortgage over 20 years instead, Bontle would need to increase her current R10 337 repayments by R1522 a month to R11 859. Not only will she pay the home loan off sooner, but she would save a massive R875 000 in interest.

When you pay in extra to your mortgage, every extra rand you pay in goes straight to the capital, immediately reducing the amount of interest you pay each month. For example, on a 20-year mortgage, by paying an extra 10% on your mortgage repayment means you would have your home paid off in just over 15 years. If you are paying in extra to your mortgage, tell your bank so it does not reduce the minimum installment to keep the loan at the original 240 months.

The added advantage of paying in extra to your home loan is that you create a buffer if interest rates increase. If you are already paying extra into your mortgage, then you would be able to absorb any increases in interest rates in the future without affecting your affordability. You also create a financial buffer if you run into financial difficulty. Any pre-paid funds (amounts you have paid over and above the minimum required) can be used to meet mortgage payments.

When things go wrong

Even if we have made all the right decisions and planned for home ownership, things can still go wrong as we have learnt only too well during the pandemic. If you find you are struggling to meet your mortgage repayment, the sooner you speak to the bank the better. The last thing a bank wants is to repossess your house, they would rather find a solution.

- Retrenchment cover: If you have been retrenched you may be able to claim on any credit insurance. This insurance is usually only automatically included when the property is of a lower value or for lower income earners. However, it is an additional extra that a homeowner can apply for.

- Draw down on pre-paid funds: You can withdraw any amount that you have pre-paid and use that to meet your monthly installment. However, you cannot simply ask the bank to take the mortgage installment from the pre-paid funds, you would have to physically withdraw it and then make the payment.

- Take a payment holiday: If your financial distress is expected to be short-lived, for less than six months, the bank may allow a payment holiday or a reduction in the monthly repayment. Keep in mind that the interest is capitalised (added to the capital) so the net effect is to extend your repayment period, and this could be significant. For example, a three-month payment break could add 12 months to your repayment period. Therefore, still try to pay a portion of your installment to cover the interest.

- Extend your mortgage period: For a longer-term solution, the bank may agree to extend your mortgage period. For example, it may restructure your 20-year home loan over 30 years. Once you are back on your feet you can simply start paying extra to settle your mortgage over a shorter period.

- Know when to sell: If your financial difficulties are more permanent, rather look at selling your home than starting to fall behind on repayments. If you can sell the property when you are not in distress, it will give you more time to find a buyer. If your property is sold in repossession, you are not likely to get the market value. Keep in mind that irrespective of how much you sell the property for, you are still liable for the full outstanding mortgage. If you sell the property for less than you owe, you will still need to come to an arrangement with the bank to repay the difference.

Table: Impact of repayment period

Bontle’s journey

Other Ways to Finance Your Mortgage and Deposit

Buying a home? Your questions answered

The City Press Home Buyers’ Guide is an educational series about property ownership. In this session our readers’ questions are answered by City Press personal finance editor, Maya Fisher-French and Wiehahn Koch, head of Business Solutions at Capitec.

So many South Africans say ‘the property market is not for me, I’m not even going to try’ – but, says Koch, you just have to ask the right questions and know where you stand. Fisher-French reiterates this – just ask, you might be surprised to find out that you can enter the property market.

Watch the Q&A session here:

Is this the time to buy?

Maya Fisher-French speaks to property specialist Ruane Bester at Just Imagine Properties

Since 2008 interest rates have fallen by 50% with the prime lending rate falling to just 7%. This has made property ownership more affordable, especially for first-time buyers. For many, mortgage repayments are in line with what they are currently paying in rent, and for existing property owners this is an opportunity to sell and upscale, especially given the demand for entry level property.

Estate agent Ruane Bester says that while interest rates have created a buyers’ market, from a sellers’ point of view the market is still attractive. “Correctly priced property will sell quickly given the high demand in the current market conditions,” says Bester, who adds that there are also area specific dynamics which drive property prices.

“In Cape Town sea-front properties will always demand higher prices regardless of the economic climate. Pretoria, for example, has its unique intricacies with location in the east, and toward Centurion/ Midrand demanding a higher premium,” says Bester. He adds that knowing this upfront will help navigate the “minefield” of choosing areas to buy in for any first-time buyer and not get discouraged by this.

Bester says from a buyer’s perspective there is also an opportunity to find well-priced homes given the economic downturn and increase in destressed sellers and an increase in emigration.

“In severe cases, where people have lost their homes and properties are going on auction as part of a distressed sale, there is no bargaining power for a seller,” says Bester. He says in cases where a seller wants to make an urgent sale, pricing is a major determining factor and properties that are put to market under these conditions literally “fly off the shelves” as real bargain hunters scoop these properties up very quickly.

However, it is not simply a buyers’ market and sellers do still have some leverage, given the higher levels of demand, especially from first-time buyers. “In most cases where properties are priced correctly, sellers are receiving multiple offers and it is important that as a buyer you are able to put in an attractive offer,” says Bester who adds that doing your homework as a first-time buyer is imperative.

“The better prepared you are, the better the chances are of finding your dream home that is correctly priced. You will not only know what to look for, but because you are more informed, you will go into this journey better prepared with less chance of being derailed by the stress and anxiety of this seemingly daunting road ahead of you.

“Like any physical exercise, one simply does not start by running a marathon, cycling the Argus for the first time or benching 120kg in a gym. You first determine your capabilities, and then you plan your steps in order to reach a certain goal.”

Homework is key, knowledge is power and by taking some of these critical first steps, you are empowering yourself to finally get a foot in the property door!

Understand your finances: When last did you go through your bank statement and scrutinise all of your expenses? A proper reflection of your expenses will give you some idea of what you can afford to cut back on to better manage your mortgage repayments. Also make sure you understand the full running costs of owning a home including rates, taxes, utilities as well as on-going maintenance costs.

Do a credit check: Ideally you want to be scoring in the good to excellent category before you apply for home finance. There may be some missed payments that need resolving or incorrect information that needs to be updated.

Get a pre-approval: Bester says a formal pre-approval on a home loan can put a buyer in a far stronger position when it comes to making an offer. A seller is more likely to accept an offer knowing that the mortgage will be approved.

Bester says with so many first-time buyers entering the market, there is a real need for property practitioners to educate around the buying and home ownership process. City Press in partnership with Capitec will be taking first-time buyers through the property ownership journey.

Be sure to follow the series as we start with a Facebook live event on 11 March.

Send us any property related questions and we will make sure we get you the answer!

Send your questions: personalfinance@citypress.co.za

What to know and what to ask your estate agent before you sign

Maya Fisher-French speaks to property specialist Ruane Bester at Just Imagine Properties about the questions a buyer needs to ask and what they should include before signing the offer to purchase

When signing your very first offer to purchase you are taking your first big step in this exciting journey of possibly owning your first home. You need to know, however, that it means exactly this: you are making an offer only. This offer needs to be taken by the estate agent to the current owner, negotiated and then accepted. Crossing this first hurdle is imperative and allows the “transaction” part of this process.

Are there other offers?

Knowing if other offers have been made on the particular property and what suspensive conditions must be met by those potential buyers will give you some idea as to your chances of having your offer accepted. It is not always about price. “If another offer is higher but they need to first sell their home, then an offer which is done with less “strings attached” may be considered above another offer,” says Bester who explains that an offer to purchase normally has a deadline attached to the offer, so familiarise yourself with this in order to know how long you’ll be sitting on the edge of your seat to hear if your offer gets accepted by the seller or not.

How long do I have to get my bond approved?

Unless you are buying the property for cash, there will most likely be suspensive conditions in your offer to purchase based on you successfully obtaining bond finance. “You must however be in agreement with the property practitioner, and physically see what they write down in terms of the timeframe you are afforded to apply and obtain bond finance,” says Bester. The standard practice is 30 days, but if your ideal home is a sought-after property with more than one buyer, then a property practitioner most likely will shorten this period. Read this section carefully. If your bond application is not successful at this stage, then unfortunately the offer to purchase becomes null and void.

When can I move in?

Bester says it is important to empower yourself with information around the registration process which should be noted in the offer to purchase. An example of this is around the occupation of the home you are buying. “Typically, one would only move into a property once the registration went through at the deed’s office. If the property you are buying is however vacated, then negotiate this with the property practitioner and one can discuss occupancy rent and the specific way one calculates this. You are then able to move into your dream home sooner.”

Ask for copies of certificates and plans:

Another important check list for yourself, relating to the registration process of the property, is to ask for electrical certificate of compliance, gas (if there is any) and electric fence. Bester says that although these are all mandatory, check that you get copies of this to keep on record. “Another useful checklist is to also request a copy of the plans for the home you are buying. Spatial Land Usage Management Act (SPLUMA) is in full force at many municipalities across the country, so this may be included as a standard item in your sale, but do ensure that you keep physical copies on record for yourself.”

Include a final inspection list:

Bester advises that you ask for a defect list or a final inspection list to be included as part of the offer to purchase as this is generally available as an addendum to the sale contract. This is to ensure the seller, property practitioner and you as the buyer, are aware of any possible defects upfront. This should also include what is included or excluded as part of the sale. Exclusion items usually included in this list could be the removal of a storage unit/ Wendy House, any special type of light fittings (think special crystal chandelier!), temporary swimming pools, kiddies’ outside jungle gyms etc.

“I’ve even had a bunch of licenced cycads that were part of this list once, as they were bequeathed to the seller by the deceased father as part of his estate to his daughters. Be sure to ask about this upfront,” says Bester.

You can also ask for certain repairs to be made as a condition of sale, such as repairing a pool leak.

What are the transaction costs?

If your home is financed, there will be two types of transactions and two sets of lawyers related to your one transaction namely the bond and the transfer. Some conveyancing attorneys can deal with both steps of this transaction, yet there are still two invoices that will be for your account to settle. “Ask for a pro-forma invoice for these fees, and negotiate for the best rate especially if one firm will deal with both the bond and transfer at the same time,” says Bester. These fees are payable upfront, at various stages in order for the property to register.

What is the process from here?

The rest of the legal steps are unique to certain transactions, for example a sale from an estate, but mostly follow three similar phases. Ask the conveyancing attorney and property practitioner during the first phase how they work with their progress reports and to be included in these communications. A lot of work goes into the first phase, with many initial administrative steps and paperwork that is necessary for the conveyancer to draw up and get the process started. “Keeping track of this is useful, but you will most likely only be required to sign all sale related documents once they are ready for you,” says Bester.

When are the fees due?

Bester says once the sale documents are signed the next phase will include the payment of the costs with various sub-components related to who is responsible for what payment. These costs include rates and clearance figures from your local town council (payable by the seller) and also the pro forma costs plus transfer duties (payable by the buyer). Once these fees are paid, the final phase of administrative preparation to lodge and register your home can proceed.

How do you mortgage proof your budget?

What costs will you incur?

How do you make the most of your home loan?

How to work out what mortgage you qualify for?

Whether you are upscaling, downscaling, buying your first home or investing in your second, the principles remain the same.

Over the next 12 weeks we will answer your questions and, using a real buyer scenario, demonstrate all the preparations you should make and pitfalls to avoid.

So, ask us on social media what questions you want answered using the hashtag #CPHomeBuyersGuide.

Tweet us on @City_Press

Find us on Facebook, City Press, or email personalfinance@citypress.co.za using ‘Home Buyers Guide’ in the subject line.

Did you know you can negotiate your bond registration costs?

These costs add tens of thousands of rands to the purchasing cost of your home and are based on the value of the mortgage.

For example, on a R1.4 million mortgage, registration costs could be as high as R34 000 in addition to transfer fees of around R48 000.

Ideally you should have saved up funds to cover these costs and avoid adding them to your mortgage balance.

Got a specific question you need answered?

Contact us: personalfinance@citypress.co.za

Capitec has recently joined the home loan market, bringing simplicity to the home loan industry. Applications can be done from anywhere, anytime on Capitec’s online home loan portal.

There are 4 steps to follow, which can be completed in less than 5 minutes. You can also keep track in real time on the progress of your home loan application.

Visit the portal here: www.capitechomeloans.co.za