Make your property

work for you

Whether you are a recent homeowner, looking to buy or earning an income from property, it is important to run the numbers writes Maya Fisher-French

Follow six ordinary South Africans as they take up the Absa/City Press Money Makeover Challenge and undergo a money makeover boot camp over six months. Each candidate has been allocated their own Absa financial adviser. The candidates will be required to complete certain financial tasks and stick to the budgets set out for them.

Did you know that you could select any repayment period for a home loan? While a 20-year home loan is the default, you could select a period as short as five years or extend it up to 30 years. The shorter the period, the less total interest you pay, saving you money. However, for many people starting out, owning their first home takes a big chunk out of their pay cheque.

Having separated from the father of her child, Maryke wanted to buy a home for herself and her daughter – a place they could call their own. As a foundation phase teacher, Maryke found her salary did not stretch far enough to qualify for a 20-year home loan. However, by financing over 30 years, she could meet the instalments.

“With property prices escalating, it has become more and more difficult for people to afford to purchase their own property,” says Maryke’s financial adviser, Leighanne Decker, who explains that affordability issues have made 30-year home loans more attractive because they immediately lower your monthly instalment.

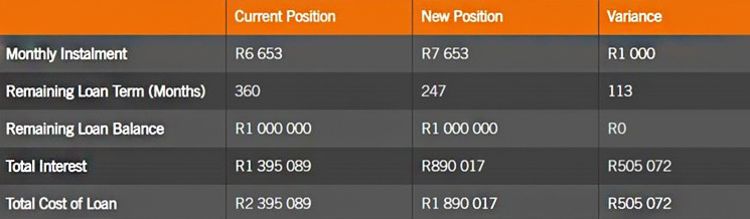

“A property of R1 million over 20 years has an instalment of R7 752 per month compared with R6 653 over 30 years. This reduces the qualifying monthly income requirement from R25 000 to R22 500,” explains Decker.

However, Decker warns that, by extending your bond by 10 years, you have in effect added 10 years worth of interest to your debt. On a property of R1 million, you could repay as much as R2.4 million. That is why one of the goals for Maryke is to start increasing the repayments to her home loan. Once she has paid off her short-term goals and started contributing to a retirement fund, she will use income from her cake side-business to focus on increasing her bond repayments.

Decker illustrates that, on a R1 million mortgage, by increasing the mortgage repayment by R1 000 a month, one pays the loan in the usual 20-year period and saves R505 072 in interest (see illustration).

“Even an additional R100 per month can have an impact over time, reducing your bond term by 17 months and saving R80 395,” says Decker.

PART 1: When to buy

Although Gugu took the courageous step of moving back home during lockdown to save money and get her finances back on track, she will soon need to make the move back to Pretoria. As she has made significant improvements in her finances – having settled her credit card personal loan and student loan – she has disposable income and could consider paying towards a mortgage.

Gugu’s plan is to purchase a flat close to work so that she can save on transport costs and she will not require a car.

“I could spend R350 000 on a car or I could use that towards a start-up apartment. I would rather save a big deposit, put that into an apartment, pay it off quickly and then invest in another property,” says Gugu. This is a smart move as many young people opt first for the car, which reduces their financial ability to purchase a home.

A one-bedroom apartment in Hatfield, for example, would cost about R700 000. If Gugu saved up a 10% deposit (R70 000), her mortgage repayments would be about R4 900 a month. This is close to what she would pay in rent, so the figures make sense.

However, Gugu will need to consider other costs. Firstly, she will spend about R44 000 on bond registration and property transfer costs. This is over and above the deposit. This means she needs to save about R114 000 before she purchases a property. Then she needs to consider monthly expenses such as levies, rates, electricity and maintenance.

As a homeowner, Gugu would need to budget for total home ownership costs of about R6 500 a month.

But, before buying into a sectional title complex, she must do her homework to ensure the place is well run and solvent – she could end up with a levy shock if the complex needed major repairs that were not budgeted for by the body corporate, which would most likely charge a “special levy” to raise the funds.

As Gugu’s debts would be settled by the time she bought the property, she would be able to increase her repayments and pay off the flat sooner.

While owning your own home is a dream for most people, make sure your finances are in order and debts are settled before you take the leap. If Gugu had committed herself to an apartment before she was debt-free, she could have found herself in severe financial difficulty.

PART 2: Earning an income from your property

Both Audrey and Nocawe plan to use property to generate income to supplement their investment goals and education costs. Nocawe purchased an investment property with cash and plans to use the income to invest for her children’s education. Audrey will be using the income from her cottage to pay for her children’s tertiary education and to supplement her retirement savings. Once the children’s education is taken care of, they can focus on increasing the repayments to their mortgage.

Audrey

Audrey

Audrey and her husband have worked on putting together enough savings, combined with a refund from the SA Revenue Service (Sars), to finally convert their garage into a cottage to rent out.

Nocawe

Nocawe

“We have sourced second-hand material to keep the costs low. There is already electricity supply, so it is just for the lights and switches and plugs in the room, kitchen and lounge area to be fitted, although the plumbing will be the biggest expense,” says Audrey, who expects to be able to rent out the cottage for R3 500 a month.

According to Miguel Martins at Absa Home Loans, when it comes to investment property, there are several things you need to consider:

What is your true profit? Make sure you include all expenses:

- Home loan repayments;

- Levies;

- Rates and taxes;

- Electricity;

- Water (if not included in the levies);

- Ongoing, seasonal and annual maintenance costs, for example, plumbing, waterproofing and painting;

- Letting management fees (if you’re going to use an agent to source and manage your property);

- Advertising fees; and

- Insurance costs.

“It is important to keep a savings buffer for when you have to do extensive maintenance, or for those months when your property is vacant. You will not have any rental income, but will still have costs,” says Martins, who adds that a rule of thumb is to have savings of at least three to six month’s worth of monthly expenses.

REMEMBER TAX

One must declare any rental income to Sars, which is added to the annual income. If the rental income exceeds R83 100 a year, the property owner would also need to register as a provisional taxpayer. In this case, the annual taxable income from the rental property would be divided into six months, with tax payable in August and February each year.

Martins says one can deduct any expenses related to the rental property, including maintenance and agent fees. If there is a mortgage on the property, one can also deduct the interest portion (not capital payment) of the mortgage.

By adding an extra R1 000 a month to your premium you reduce this drastically as your cost of your loan will now cost you R1 890 017. This is based on an interest of 7%pa and a mortgage of R1 million.

Own name or legal entity?

Nocawe bought her property off-plan and is still waiting for the property to be completed and transfer to take place. She is considering whether to put the property in her name or in a company or trust.

If you plan on building up a property portfolio and running it as a business, like last year’s Money Makeover candidate Colen, then holding the properties in a separate legal entity does make sense. You ring fence the profits and liabilities and separate them from your personal finances.

However, if you only have one or two properties and wish to use them to supplement your income, Martins says it is not necessary to incorporate and you need to understand the increased costs:

- The bank may require likely require a higher deposit if you purchase in a Trust or Pty, versus in your own name.

- As an individual the maximum Loan to Value may be up to 100%, whilst financing in a company name, the maximum may be 80%.

- In addition, Bank Initiation Fees and Monthly Service Fees may be higher for Legal Entities (specifically non-NCA Legal Entities)

- Document requirements for legal entities are also more/ different in comparison to the document requirements of an individual e.g. company docs, financial statements signed by either a registered Auditor, Chartered Accountant or Accounting Officer, IT34 (in some cases) etc.

- There are also additional requirements when buying as a legal entity such as annual financials which need to be drawn up and submitted to SARS.

You can follow the story on social media #CPMoneyMakeover

Facebook: @CPMoneyMakeover

Twitter: @CPMoneyMakeover

Subscribe below for the Money Makeover Newsletter