Boundaries: Money and family

Seldom is a money journey undertaken alone. Here are how our contestants have tackled tricky conversations to build better relationships with family and with money, writes Maya Fisher-French

Our finances affect all parts of our lives, including our relationships. Your money journey may include a spouse, a parent, a child or other family you may be supporting. These are not always easy, but they are the most important conversations you need to have.

Lending money to family: This leads to conflict

The Old Mutual Savings and Investment Monitor which surveys South African households each year, found that when it came to debt priorities, paying back family comes last. People are more likely to pay back a lender such as a financial institution than they are family members. If you cannot afford to write off that debt, avoid lending money to family.

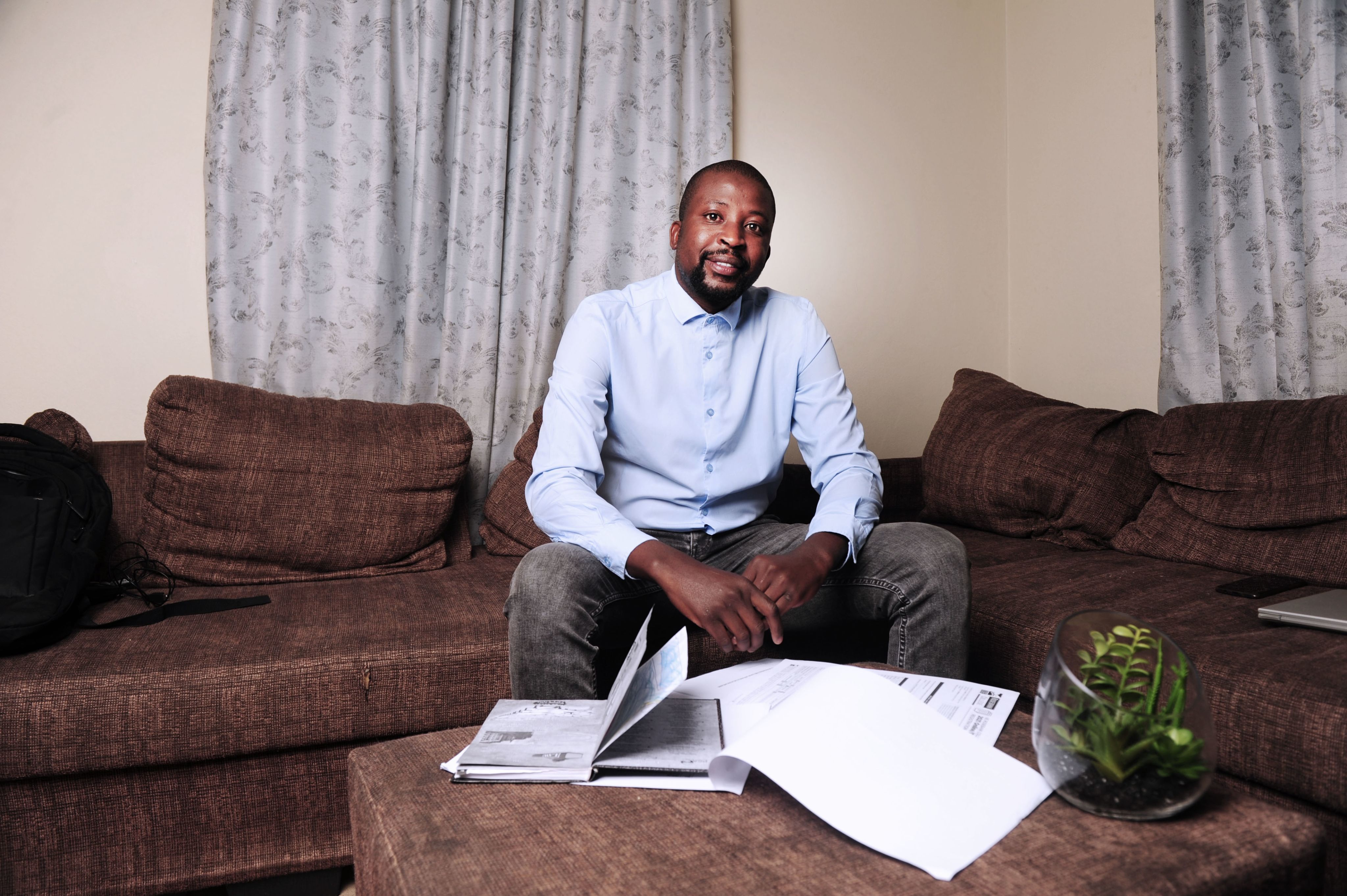

Lecturer Zinzy found herself in a difficult situation when she agreed to take over her brother’s car debt, putting the car finance in her name. While her brother agreed he would repay her the amount owed each month, within a few months he stopped paying.

As Zinzy did not have the money to cover the repayments, she defaulted on the loan. The financing company was understanding of the situation, but ultimately, she had to return the car or start the payments. Her brother avoided contact with her and would not tell her where the car was being kept. When Zinzy entered the Money Makeover Challenge this debt was causing her immense stress.

Zinzy took the decision to inform the rest of her family about her brother’s default. Zinzy, along with her siblings, equally contribute each month to their parents’ household. Zinzy informed her family that she would be reducing her family contribution so she could meet the car finance repayments. Her sister immediately spoke to her brother, and he began to meet his financial obligations.

“The hardest part was opening up to my sister,” says Zinzy who explains that her sister is a “no-nonsense” person who would call out the brother immediately.

“I must admit that I felt guilty that I was betraying the agreement between my brother and me. I thought I was rocking the ‘family-dynamics boat’. However, I was surprised by her response. She was very receiving of my approach and handled the talk with my brother with care. This in turn gave me courage to make changes. I felt that I had someone in my corner, who can help put more pressure on my brother and his actions. It was a relief.”

Once Zinzy had spoken to her sister, she put her intention on the family WhatsApp group.

“I felt that it was the best way to open the communication channels, whilst also getting my point across uninterrupted. It was liberating and proved to me that I do not need to suffer alone, just speaking out can inspire courage to take a firm, much needed stance.”

The approval from her older sister was important to Zinzy. She realised she should not feel guilty for holding her brother to account. Sometimes, we need that person who will give us permission to stand up for ourselves. Identify who that person is and ask them to support you emotionally if you are facing a challenging conversation.

Holding a father accountable: Do it for the child’s future

As part of her journey, Zinzy identified that she struggled to confront people who owed her money. Having seen the benefit of asking her family to help hold her brother to account, Zinzy knew she must deal with her son’s father who had not kept to the maintenance agreement.

“I had to remove any feeling and focus on how it would make my son’s life better. I realised that I had to let go of the notion that I can do it all by myself and hold the father to his responsibility,” says Zinzy who contacted the lawyer who had helped with the parenting agreement.

“He was willing to give the father a call before we began the court route. I was dreading the whole court process, but I am relieved of the outcome. He has started to pay, and if he defaults, I can go to maintenance court without any feelings of guilt because I have tried all avenues available to me.”

What Zinzy has learnt in her money journey is that it is okay to ask for help and that when people mis-treat you financially, they are the ones who should be held accountable.

Working with family: Make it empowering

It is not uncommon for entrepreneurs to employ family members in the business. This creates employment in the family and is often someone you can trust. However, it is important to have boundaries and separate the family and the business financially. Working “for free” in exchange for food and accommodation hides the true cost and the profitability of the business. It is not empowering for the family member who is not encouraged to take financial responsibility. A preferred approach is to pay a salary. The employed family member in return contributes to the household expenses.

Motsei employs her hearing-impaired nephew in her VIP Flushable Mobile Toilets. As part of the Money Makeover Challenge, Motsei did a cost analysis of her business and now pays her nephew the going rate for domestic and garden staff in her area.

She is educating him around money management by helping him open a bank account. She gives him a list of groceries, worth about R300, that she requires him to purchase for the household.

“I can see he has taken better care of himself; apart from meeting his obligations he bought himself a beautiful pair of sneakers, socks and enough toiletries.”

Motsei has seen a significant difference in his attitude to work. “He is enthusiastic and is even taking initiative to see to the minor maintenance of the toilets without being pushed. This gentleman has come a long way really, seeing him being able to do stuff for himself and contributing to the house is a major milestone.”

Money and your partner: be honest

As part of the journey, our candidates are required to talk to their partners. This often involves admitting financial difficulties and asking for help.

When Sandra entered the Money Makeover Challenge she struggled to explain her fears around managing money to her fiancé and father of their daughter. As he works abroad, she is left to manage the household expenses. Sandra has put a budget in place and feels more in control of her money, she now finds it easier to discuss.

“Now that I have a budget and know exactly where our money is going when I approach him about money matters I am able to do so in a more meaningful way. In the past he would ask me probing questions which I couldn’t answer because I didn’t know what our finances looked like. Rather than answer him I would get so frustrated. But since I’ve owned my role as the person in charge, I am able to engage him and guide the ship, so we don’t find ourselves in the same situation again.”

Carrying the full financial burden of the household weighed heavily on Wisani since his wife lost her job last year.

Now the couple have a plan and are working on it together. Part of any financial discussion must identify household goals and how you will achieve these.

“I have been able to discuss all my financial issues with my partner. She advised me to start tackling smaller debts if we are to achieve the bigger goal of becoming debt free and finishing my mother's house. As part of our discussion, we came up with a plan that once I have paid off most of the debt, I should start saving money for rainy days. We will put money away for emergencies, such as funerals, family members getting sick and we need to assist and all other unforeseen circumstances.”

If you really want to get your finances in order, you have to start tracking your spending. If you cannot commit to that, it is unlikely you will be able to reach your goals.

Follow the journey – and join in – @CPMoneyMakeover on Facebook and Twitter

Absa Enterprise Development assists SMEs with access to business development support, markets access and access to funding based on certain criteria’s being met. For further information on Absa Enterprise Development you can email ed@absa.africa

You can follow the story on social media #CPMoneyMakeover

Facebook: @CPMoneyMakeover

Twitter: @CPMoneyMakeover

Subscribe below for the Money Makeover Newsletter